Solar energy investment presents a compelling opportunity to lower energy expenses while embracing a more sustainable lifestyle. Nonetheless, the upfront expense of installing solar panels can often discourage numerous homeowners and businesses. There are numerous financing options available today, including loans, EMIs, and leasing options, that can significantly enhance the affordability of solar installation.

Numerous solar installation companies in Jaipur are dedicated to making things easier for you. We will explore loans, government schemes, subsidies, and a range of financing options provided by solar EPC service providers in Jaipur to help you make a well-informed decision and begin saving on your energy bills.

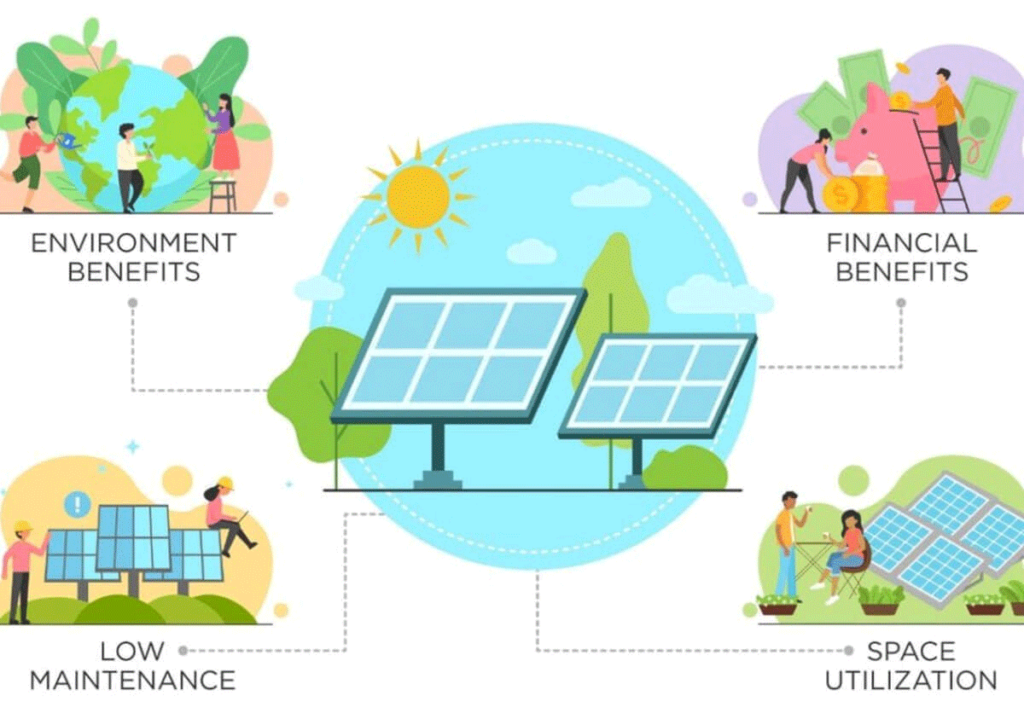

Why Invest In Solar Energy?

Solar energy offers an environmentally friendly solution while also providing significant savings on utility bills over time. After installation, solar panels require very little maintenance and can endure for 20-30 years, frequently recouping their investment multiple times over.

Although the upfront cost might seem significant, the opportunity for substantial long-term savings, available government incentives, and a lower environmental footprint truly justify this investment. With various financing options available, this transition becomes increasingly attainable, enabling a growing number of individuals to experience the advantages of solar energy.

1. Solar Loans For Residential Solar Solutions

Getting loans to install solar panels is one of the easiest ways to finance it. So, it’s a way to get solar panels installed at home even if we’re a bit short on cash. So, with a solar loan, you can borrow some cash to pay for the installation costs, and then you just pay it back in monthly installments. You’ve got a variety of loans out there, and each one comes with its own unique perks.

Types of Solar Loans

- Secured Solar Loans: These usually need something like your home as collateral, but they tend to come with lower interest rates overall.

- Unsecured Solar Loans: You won’t need to put up any collateral for these, but keep in mind that they might come with higher interest rates and a solid credit score is a must.

In Jaipur, a bunch of “solar installation companies” team up with banks and credit unions to provide specialized solar loans for home projects. Some banks have lower interest rates for green energy loans, which makes it easier for customers to switch to solar energy.

Benefits of Solar Loans

- Ownership: You completely own the system, which means you can take advantage of tax incentives and boost your property value.

- Flexibility: Loan terms usually go from 5 to 20 years, giving you the chance to pick a monthly payment that works for your budget.

- Government Rebates: You might be able to get government grants and refunds if you own the system, which would lower the total cost.

Some well-known Indian banks like State Bank of India (SBI), Bank of Baroda, and Punjab National Bank provide loans specifically for solar projects, featuring appealing rates and good terms.

Also Read : Discover the Cost-Saving Brilliance: Unveiling the 9 kW Solar System Price in Rajasthan with Subsidy

2. EMI (Equated Monthly Installments) Options From Solar Companies In Jaipur

Many solar companies in Jaipur help create financial plans with EMIs for people who prefer to make monthly payments that they can handle. With this option, you can pay for the installation over several months by making small, fixed payments.

Features of EMI for Solar Installations

- Flexible Tenure: You can choose EMI plans that last anywhere from 6 months to 5 years, making it easier to manage your payments according to what feels right for your budget.

- Low or No Interest Options: Some companies that install solar panels offer EMI plans with no or low interest, which makes installing solar panels more affordable.

- Ease of Access: Many solar companies in Jaipur offer EMI options through partnerships with banks or their own financing plans.

EMIs are great for anyone interested in “residential solar solutions” but might not have the cash upfront. They allow you to start saving on energy bills right away!

3. Subsidies And Government Incentives For Solar Installations

Government subsidies are one of the best reasons to switch to solar power. The Ministry of New and Renewable Energy (MNRE) in India offers money to people and businesses that want to switch to solar power.

National and State-Level Solar Subsidies

- MNRE Subsidy: MNRE subsidises household solar installations up to 40% and 20% for systems up to 3 kW and 10 kW, respectively.

- State-Level Subsidies in Rajasthan: The Rajasthan government offers solar energy incentives to homeowners. These subsidies cover part of residential and small commercial installation costs but vary.

Here is a list of the main programs that offer subsidies to make going solar more affordable:

1. PM KUSUM Scheme

- Purpose: Finances agricultural solar pump installations.

- Subsidy Details: Solar pump installation expenses are subsidised 60% and financed 30%.

- Eligibility: Farmers and people who own land for farming.

- Documents Required:

- Aadhaar card

- Land ownership proof

- Bank account details for subsidy transfer

- KYC documents for loan application

- Application Process:

- Select an MNRE-approved vendor.

- Submit all necessary documents to the vendor.

- Vendor submits application on behalf of the applicant.

- Subsidy amount is transferred to the applicant’s bank account upon approval.

2. PM Suryoday Yojana

- Purpose: Helps with installing solar panels on homes.

- Subsidy Details: 20% subsidy for systems 3–10 kW; 40% for systems up to 3 kW.

- Eligibility: Homeowners and housing societies for residents.

- Documents Required:

- Proof that you own the property or a lease deal

- Government-issued ID (Aadhaar or PAN card)

- Bank account details for direct subsidy transfer

- Application form from an MNRE-approved vendor

- Application Process:

- Verify eligibility with an MNRE-approved vendor.

- Prepare and submit vendor-required papers.

- Vendor submits MNRE application.

- Once authorised, subsidy is deposited into the applicant’s bank account.

3. Rajasthan State Subsidy

- Purpose: Adds incentives for Rajasthan home and small business solar systems.

- Subsidy Details: Up to 10–20% additional MNRE subsidy for residential projects; partial subsidy for small businesses.

- Eligibility: Residential and small commercial property owners in Rajasthan.

- Documents Required:

- Proof of Rajasthan residency or agricultural certification

- Property ownership document

- Vendor deal with an MNRE-approved company

- System specs and installation invoice

- Application Process:

- Install with an MNRE-approved local vendor.

- Provide the vendor with all required documents.

- Vendor helps with subsidy applications.

- After approval, the subsidy is deposited into the applicant’s bank account.

Solar energy is more affordable for homeowners, farmers, and small business owners thanks to these subsidies. Work with an MNRE-approved “solar installation company in Jaipur” or other region to ensure compliance and simplify the application process.

4. Bank Schemes For Solar Financing

Indian banks see the promise of solar energy and have come up with special loans and programs to lower the cost of solar systems. Here are a few well-known bank programs that aim to encourage people to use solar power.

State Bank of India (SBI) Green Energy Loan

- Loan Amount: Individual solar installers might get INR 10 lakhs.

- Interest Rate: Flexible repayment choices and competitive interest rates (8-10%).

- Tenure: Monthly payments are affordable for 10 years.

Bank of Baroda Solar Loan

Also Read : 15kw Solar System Price In Jaipur With Subsidy: A Complete Guide

- Loan Purpose: Pays for home and business solar panel installations.

- Interest Rates: Rates for green energy projects have been lowered.

- Eligibility: Bank of Baroda lends to individuals and businesses, making it a good choice for solar EPC service in Jaipur and residential projects.

Punjab National Bank (PNB) Green Energy Loan

- Maximum Loan Amount: Individual solar installations cost INR 15 lakhs and commercial ones INR 1 crore.

- Interest Rates: PNB encourages renewable energy with reasonable prices.

- Flexible Terms: Low monthly payments for homeowners with 15-year loans.

Banks often work with licensed solar installation companies in Jaipur to make sure that customers can easily get the money they need.

5. Solar Leasing And Power Purchase Agreements (Ppas)

“Solar leasing” or a “Power Purchase Agreement (PPA)” can be good options if you want to add solar but don’t want to own the system. With these choices, the solar company puts the panels on your home, but you don’t own the system.

How Leasing and PPA Work

- Solar Leasing: Solar leases cost a set amount every month.

- Power Purchase Agreement (PPA): Your energy bills drop without upfront costs since the system generates electricity at a lower rate than the utility.

“Solar companies in Jaipur” are offering more and more of these choices, which makes it easier for low-income families to go solar without having to make a big investment. But because you don’t own the system, you might not be able to get some tax breaks or help from the government.

6. Green Home Equity Loans And Lines Of Credit

“Home equity loans and lines of credit (HELOC)” are a good way for homeowners who have built up equity in their home to pay for solar systems. You can get money at low interest rates by using the wealth in your home.

Home Equity Financing Benefits

- Lower Interest Rates: Home equity loans have lower rates than unsecured loans.

- Long Repayment Period: Many HELOCs have 10-20-year repayment terms, reducing monthly costs.

- Tax Deductions: Home equity loan interest for energy-efficient home upgrades may be tax-deductible.

Home equity loans are available from most of India’s major banks, such as SBI, HDFC, and ICICI. They are especially helpful for bigger home improvements or installations.

7. Solar Company Financing Programs And Special Schemes

A lot of solar EPC services in Jaipur offer financing through their own companies. These loans are often called “solar loans.” These financing plans are made just for solar installations, making it easier and faster to get the money you need.

Benefits of In-House Solar Financing

- Single-Point Solution: The solar installer handles finance and installation, making it easy.

- Faster Approval: Since the solar company oversees financing, you may get approval faster than with banks.

- Flexible Payment Terms: In-house finance offers customisable payment choices from months to years.

This choice is great if you want an easy and straightforward way to finance your solar project with terms that are open enough to fit your needs.

Also Read : 20kw Solar System Cost In Jaipur: Everything You Need To Know

Comparing Financing Options For Solar Solutions In Jaipur

There are several choices, and the best one for you relies on your budget, goals, and personal tastes. Here’s a quick look at the two to help you decide:

| Option | Ownership | Upfront Costs | Maintenance | Ideal For |

| Solar Loans | Yes | Medium | Owner’s Responsibility | Homeowners with good credit |

| EMI Plans | Yes | Low to Medium | Owner’s Responsibility | Flexible budgeting |

| Solar Leasing | No | Low | Provider | Low upfront costs |

| Power Purchase Agreements (PPA) | No | Low | Provider | Lower energy bills |

| Bank Solar Loan Schemes | Yes | Medium | Owner’s Responsibility | Long-term financing |

| Solar Company Financing | Yes | Low to Medium | Owner’s Responsibility | Convenient, quick approval |

Conclusion

Getting the right funding for your “solar installation in Jaipur” can make a big difference in how much you can afford and how much you save in the long run. Loans from banks and EMIs, government grants, and leasing are all choices that can fit a range of budgets. There are programs in Jaipur’s “solar EPC services” and banking institutions that can help you switch to clean, renewable energy, whether you want to own the system or have more control over your payments. By going solar today, you can lower your electricity costs, raise the value of your home, and help make the world a better place for everyone.

FAQs

1. What are the benefits of using solar financing from banks?

Bank solar loans have lower interest rates and flexible periods, making solar installation more affordable. Specialised solar energy loans are offered by SBI and PNB.

2. Are there government subsidies for residential solar solutions?

Small home solar systems receive up to 40% MNRE subsidies, with Rajasthan state rebates.

3. What is the difference between solar leasing and a PPA?

Solar leasing charges a monthly fee to utilise the panels, but a PPA charges less than utility rates for the electricity generated.

4. How do EMI plans work for solar installations?

EMI plans let you pay for the solar system over a period of months, and solar companies in Jaipur usually offer plans with low or no interest rates.

5. How do I choose the best solar financing option for my home in Jaipur?

Your credit score, budget, and financial goals determine it. Loans offer ownership, but leasing and PPAs offer low upfront payments. A Jaipur solar installation firm can also offer personalised advice.